Week 5 Discussion Distinction Between Independent Contractors and Employees magine that a potential employer has given you the opportunity to work as either an employee or an independent contractor.

in Business (Education) by vommsYour Price: $5.00 (30% discount)

You Save: $2.14

Description

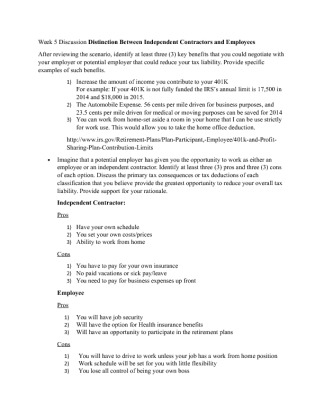

Week 5 Discussion Distinction Between Independent Contractors and Employees After reviewing the scenario, identify at least three (3) key benefits that you could negotiate with your employer or potential employer that could reduce your tax liability. Provide specific examples of such benefits. 1) Increase the amount of income you contribute to your 401K For example: If your 401K is not fully funded the IRS's annual limit is 17,500 in 2014 and 18,000 in 2015. 2) The Automobile Expense. 56 cents per mile driven for business purposes, and 23.5 cents per mile driven for medical or moving purposes can be saved for 2014 3) You can work from home-set aside a room in your home that I can be use strictly for work use. This would allow you to take the home office deduction....