Aluminum Industries, Inc Fi 360 Financial Management Week1 Answers

in Economics by vommsYour Price: $9.00 (30% discount)

You Save: $3.86

Description

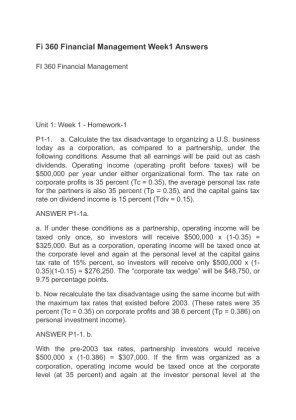

Fi 360 Financial Management Week1 Answers

FI 360 Financial Management

Unit 1: Week 1 - Homework-1

P1-1. a. Calculate the tax disadvantage to organizing a U.S. business today as a corporation, as compared to a partnership, under the following conditions. Assume that all earnings will be paid out as cash dividends. Operating income (operating profit before taxes) will be 500,000 per year under either organizational form. The tax rate on corporate profits is 35 percent (Tc ), the average personal tax rate for the partners is also 35 percent (Tp ), and the capital gains tax rate on dividend income is 15 percent (Tdiv ).

ANSWER P1-1a.

a. If under these conditions as a partnership, operating income will be taxed only once, so investors will receive 500,000 x () ...