Accounts Receivable Bad Debt Expense (Direct Write Off Method Vs Allowance Method) Based on the information in the video, discuss the primary advantages and disadvantages

in Other (Other) by vommsYour Price: $4.50 (30% discount)

You Save: $1.93

Description

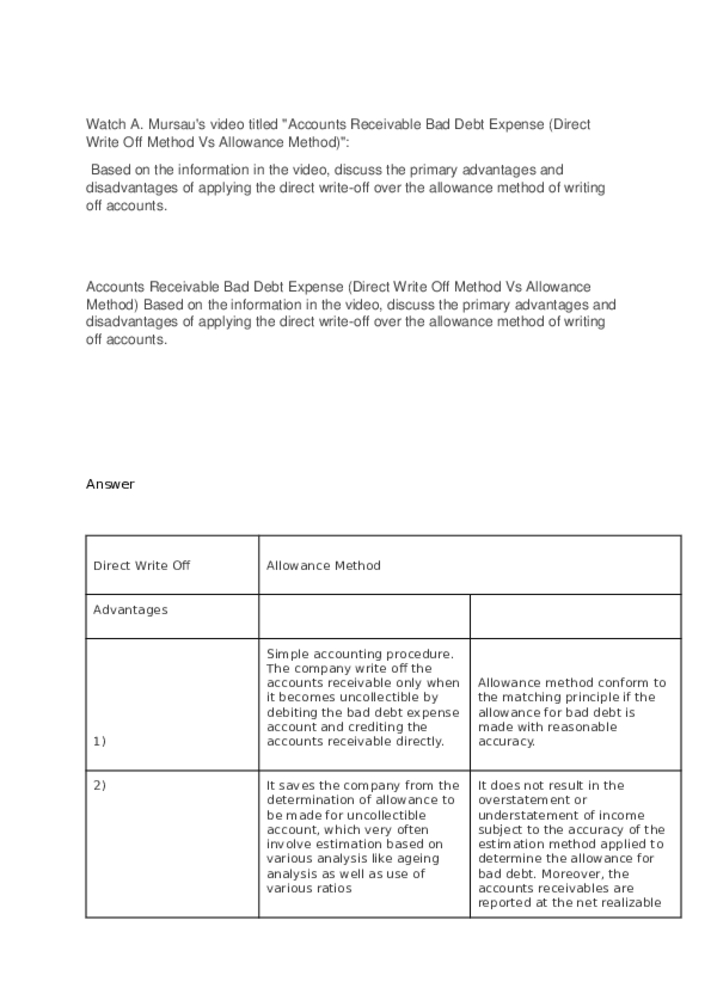

Watch A. Mursau's video titled "Accounts Receivable Bad Debt Expense (Direct Write Off Method Vs Allowance Method)": Based on the information in the video, discuss the primary advantages and disadvantages of applying the direct write-off over the allowance method of writing off accounts.

Accounts Receivable Bad Debt Expense (Direct Write Off Method Vs Allowance Method)Based on the information in the video, discuss the primary advantages and disadvantages of applying the direct write-off over the allowance method of writing off accounts.

Answer

Direct Write Off Allowance Method Advantages

1) Simple accounting procedure. The company write off the accounts receivable only when it becomes uncollectible by debiting the bad debt expense account and crediting the accounts...