ACC 610 Financial Reporting 1 Answers

in Accounting by vommsYour Price: $27.99 (30% discount)

You Save: $12.00

Description

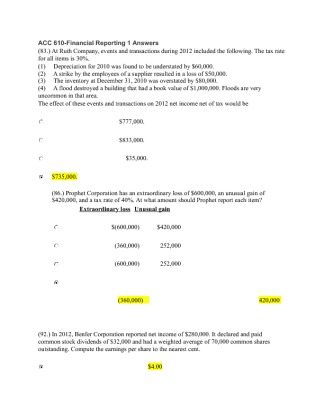

ACC 610-Financial Reporting 1 Answers

(83.) At Ruth Company, events and transactions during 2012 included the following. The tax rate for all items is 30%.

(1) Depreciation for 2010 was found to be understated by 60,000.

(2) A strike by the employees of a supplier resulted in a loss of 50,000.

(3) The inventory at December 31, 2010 was overstated by 80,000.

(4) A flood destroyed a building that had a book value of 1,000,000. Floods are very uncommon in that area.

The effect of these events and transactions on 2012 net income net of tax would be

777,000.

833,000.

35,000.

735,000.

(86.) Prophet Corporation has an extraordinary loss of 600,000, an unusual gain of 420,000, and a tax rate of 40%. At what amount should Prophet report each item?

Extraordinary...